March 04, 2024: Inflation Figures Boost EURO

March 04, 2024

Market run-through

The last seven days have witnessed a significant milestone in global equity markets, as major indices like the DOW, S&P 500, DAX, CAC, and even Nikkei all reached new record highs. The wind in the equity market’s sails can largely be accredited to positivity surrounding artificial intelligence and the broader tech sector. Additional fuel, if ever any was needed, came in the form of China’s surprise rate cut. This unexpected, but welcome turn of events injected further momentum into an equity market landscape already primed and pointing to the upside. As discussed last week, the unmistakable hawkish tone set by the Fed minutes has resulted in a revision of rate cut expectations. This shift in sentiment can clearly be seen in Fed fund futures, where market participants now see a 33% chance that the Fed will maintain interest rate levels (5.25-5.50%) following their meeting in June. That is a huge departure from the 0% chance which was the consensus just 30 days ago.

The EURO has been lifted this week by stronger-than-anticipated inflation figures, which suggest that the path to disinflation may be encountering a few bumps in the road. These developments could provide all the justification needed for the hawks within the ECB to continue advocating for a cautious approach with regard to rate cuts. Evidence of this can plainly be seen in Governing Council member Robert Holzmann’s remarks this week, which underscored the need for patience and caution in monetary policy decisions: “We have to wait” and “cannot rush to a decision”. Holzmann’s timing, however, did raise one or two eyebrows as his remarks were made during ECB’s quiet period before its upcoming meeting less than a week away.

Turning to the UK, market participants are looking for fresh clues about when the Bank of England will start reducing interest rates. The latest poll from Reuters showed that a rate-cut move from the BoE will come in the third quarter of this year, with a slim majority expecting it in the month of August. Currently, BoE policymakers are giving the markets guidance that rate cuts would be discussed only after they are confident that inflation will come down to their desired level of 2%. Their concerns emanate from the pace at which wage growth and service inflation is still rising. The momentum in these two indicators is higher than they feel is necessary for returning inflation back to the 2% target.

Andy Demetriades, FX and Payment Partnership Team Lead

Behind the desk

The current trajectory of Bitcoin (BTC) can be succinctly captured by the term “dominance.” The notion of a “pullback” seems foreign to BTC, as it appears to be embarking on an uninterrupted journey to new heights. Remarkably, BTC has shattered previous patterns by reaching all-time highs prior to halving, a phenomenon largely attributed to the influx of institutional capital reshaping the landscape.

This impending halving promises to be unlike any before, with unprecedented factors at play: widespread adoption by nations, the emergence of spot BTC ETFs, and sustained retail interest. Demand is surging while the supply remains static, as evidenced by the recent withdrawal of $1 billion worth of BTC from Coinbase. Bulls are firmly in control, evident in the market’s resolute hold.

Bitcoin ETFs are rewriting records, now commanding nearly 4% of the total Bitcoin market after just over a month of trading. It’s staggering to contemplate the evolution of an asset that emerged a mere 12 years ago from nominal value to its current colossal stature.

Initial expectations of a pullback before reaching the $69,000 price mark have been defied, with BTC seemingly unstoppable. ETFs have drained OTC crypto reserves, necessitating public exchanges to meet investor demand, thereby propelling the asset’s price further. All this transpires ahead of the impending supply shock in a matter of weeks.

Speculation abounds regarding Ethereum spot ETF products and their potential approval. Bitcoin’s dominance has eclipsed ETH, evidenced by the downtrend in the ETHBTC price since February 26th. The political dimensions of SEC approval weigh heavily, casting doubt on whether ETH ETFs will receive similar treatment to BTC.

At the trading desk, vigilant monitoring of Bitcoin’s price remains paramount, particularly as its volatility spills over into other assets like ETH, LTC, and BNB—coins that continue to exhibit robust activity. These unfolding events offer an exhilarating spectacle, with new milestones materializing on a weekly basis.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

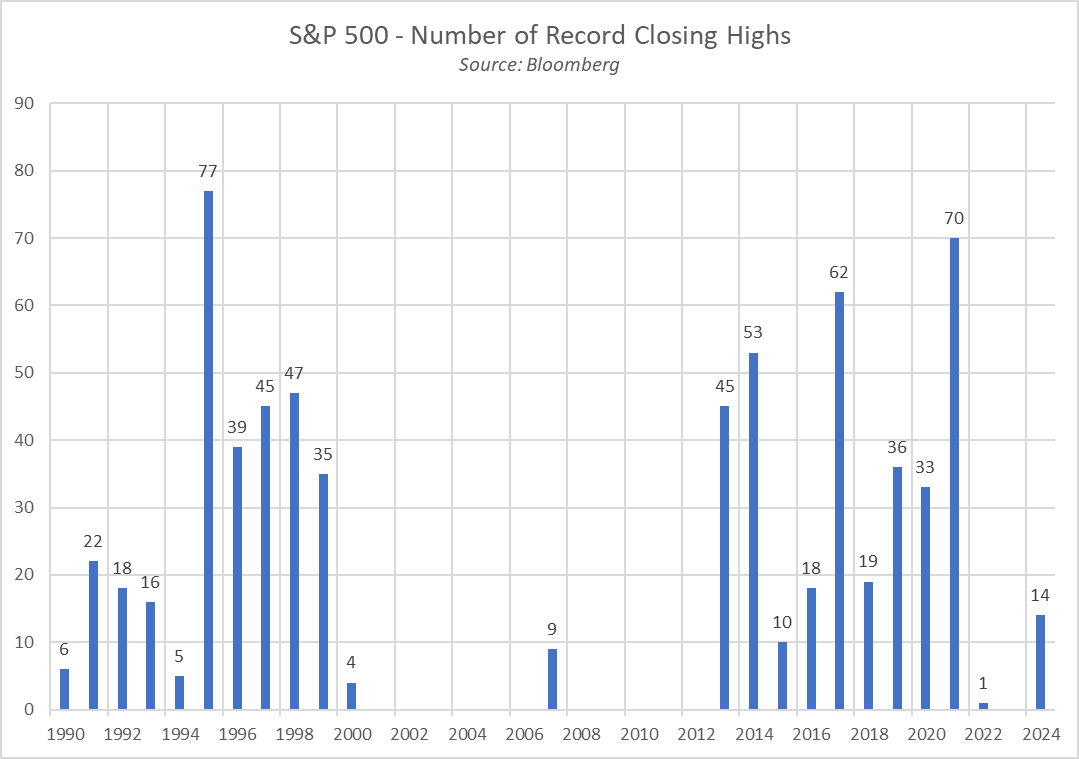

Somewhat unbelievably, we are already over a sixth of the way through 2024 – as they say, time flies when you’re having fun! The S&P 500, and equity bulls more broadly, are certainly having plenty of fun at present, with the US benchmark having already rallied around 7% since the turn of the year, and having already notched 14 fresh record closing highs. A rather crude extrapolation of this trend over the remainder of the year – which, to be clear, is more for fun than to add any sort of trading signal – would see the S&P print over 80 ATHs in 2024, the most since the index’s inception. Nevertheless, it does seem likely that the ‘path of least resistance’ will continue to lead higher for risk assets over the medium-term, particularly with US economic growth remaining solid, disinflation set to continue, and the policy backdrop likely to become increasingly supportive as the year progresses, with rate cuts on the horizon, and QT set to come to a conclusion. Combined, all this should see market participants’ risk appetite continue to increase, while also keeping a lid on equity vol for the time being.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.