June 17, 2024: It’s Not Just Football Kicking Off In Europe

June 17, 2024

Market run-through

Last Wednesday, Jay Powell and his team delivered a slightly more hawkish message than some traders had expected as they pushed the prospect of sustained easing into next year. We are moving closer to a cut with CPI, PPI, and employment all dipping, but the election looms, which may make the FOMC more cautious than it would otherwise be. Last week, the markets started reacting to elections closer to home. In particular, they gave the French markets a good kicking after President Macron called for a snap election. His decision lays open the divisions within France and may well backfire on the incumbent and his Renaissance party. With political instability, an anathema to financial markets, we may have an uncomfortable few weeks ahead for the single currency.

Political instability almost seems to be a way of life in the UK, and it is certainly not immune to the populist surge, with both the big two parties in the UK suffering from the surge in support for Reform. Whether the popularity will translate into seats will be revealed on 5th July, but prior to that date, this coming Thursday, we have the Old Lady’s MPC sitting and delivering its verdict on interest rates. The Bank of England has cancelled all speeches until after the election, and with no press conference or monetary report, it would be a major surprise if they cut rates. With a new administration imminent, it is almost sure that Andrew Bailey’s enthusiasm for a cut will have to be tempered until the end of summer, with September looking most likely. With LNG futures slowly increasing and disruption continuing on world shipping routes, the hesitancy of central banks may eventually be seen as a wise move.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

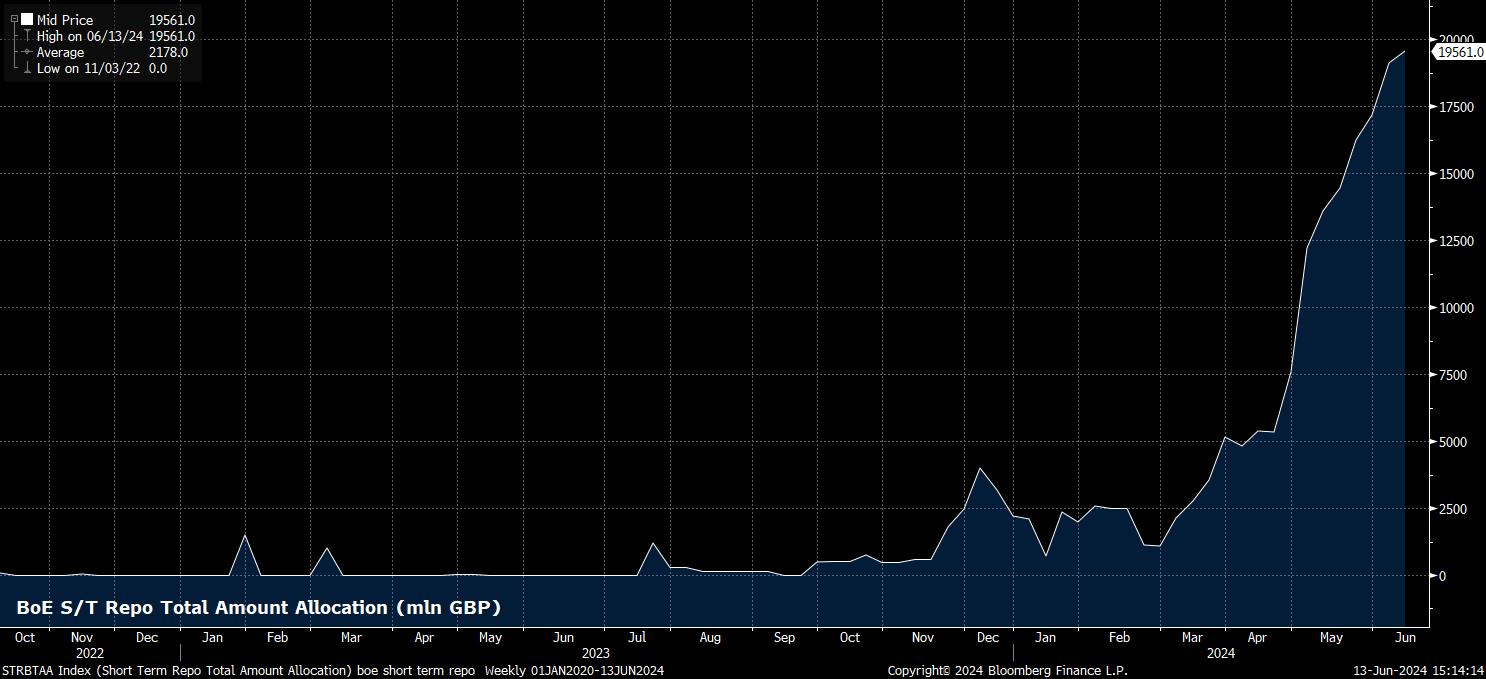

We dig, this week, into financial plumbing, a subject that is often rather ignored, until all of a sudden it is thrust onto the radars of market participants worldwide, when things begin to seize up. At the moment, there are some signs beginning to emerge of such a funding issue within the UK, as the BoE continue an aggressive pace of quantitative tightening, including the active sales of gilts held on the balance sheet. Rather sooner than expected, these sales appear to be triggering a shortage of cash within the economy, as usage of the BoE’s short-term repo facility has surged to almost £20bln, with record demand having been seen in each of the last eight weeks. Though the MPC have ceased public remarks due to the election, Governor Bailey expressed relatively little concern about s/t repo usage back in May, when last asked about the issue. Nevertheless, as repo usage continues to rise, and the cash shortage likely intensifies, it seems increasingly likely that the BoE will bring active gilt sales to an end at the annual review in September, thus representing a further easing in policy, likely around a month after the first rate cut, set to be delivered at the August meeting.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.