June 24, 2024: Fish Are Jumpin’, And The Cotton Is High

June 24, 2024

Market run-through

The Summer Solstice has come and gone, and the days have started to shorten in the Northern Hemisphere. But for many, summer is just beginning, and certainly in Europe, thoughts of lazy days on the beach and warm swims are starting to preoccupy thoughts. However, here in the UK and France, elections are to be won and lost before traders can fully relax. The election in the UK looks like a nailed-on victory for Keir Starmer and his Labour party, whose economic policy he summed up as growth, growth and more growth eerily reminiscent of Liz Truss. The picture across Le Manche looks far more challenging with France and its politically deeply divided. Whoever wins, the chaos in the French bond market will likely continue through the summer as a confrontation is certain between the winner and the European Council, who are expected to put France under EDP. With the new government under tight economic constraints, any election promises will need to be diluted rapidly, which could inflame the existing tensions.

America of course has its own election fast approaching which could be every bit as inflammatory as the one in France. Thankfully for the next couple of weeks we can focus on the economy and inflation. Despite speakers from the Fed still singing from the hawkish hymn sheet, the data is starting to show softening and this week’s PCE Deflator, published on Friday, is expected to continue this trend with a 0.2% forecast and possibly even 0.1%. If the number comes in around these levels and the employment data published next week shows another uptick in inflation, bets on a September cut in interest rates will rise and as they do the dollar should soften, potentially impacting the economy. All to play for then over the next two weeks before the markets can really put their summer sandals on.

Richard Matthews, Head of FX and Payment Partnerships

Chart of the week

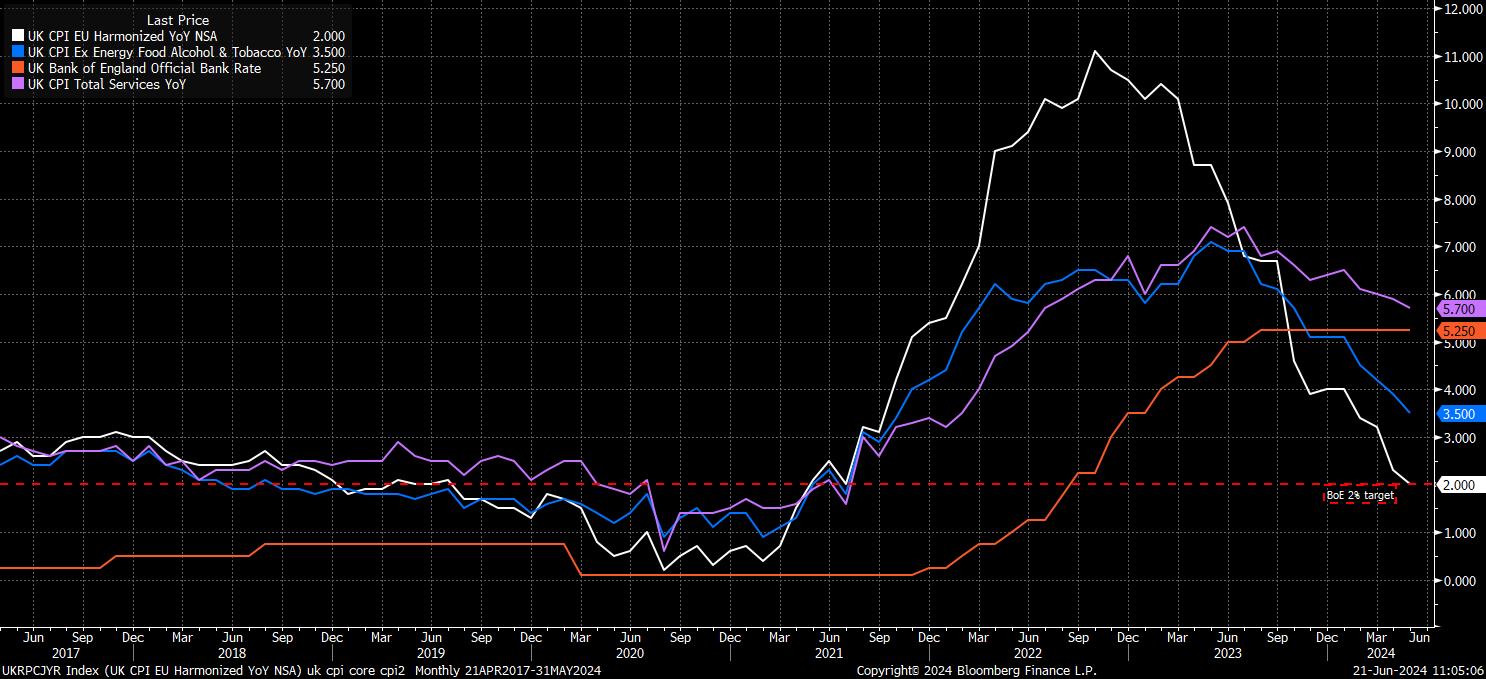

Andrew Bailey was, probably, the happiest man in the City of London last week, after the latest inflation figures showed headline CPI falling back to the BoE’s 2% target, in May, for the first time since the middle of 2021. Following this, on Thursday, the MPC took a step closer to delivering the first Bank Rate cut of the cycle, noting that the decision to stand pat on policy was “finely balanced”, with further reporting indicating that this was the case for three policymakers who opted to keep rates unchanged. Of course, if these three were to join the 2 (Dhingra and Ramsden) already voting for a cut, there would be a 5-4 majority on the MPC for such action – my base case remains that the first cut will come at the next meeting, in August. Nevertheless, there are still signs that the UK economy is not fully ‘out of the woods’ – services inflation continues to run just shy of 6% YoY, and 0.4pp above the BoE’s own forecasts, while earnings growth runs at a similar level, albeit having been somewhat skewed by the recent minimum wage hike. In any case, until both these metrics show some further signs of cooling, the Old Lady is likely to remain relatively restrained in the pace and magnitude of loosening that is delivered.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.