Best Ways To Transfer Large Sums Of Money Internationally

With so many options, finding the best way to transfer money internationally can be daunting for a business of any size. How do you know which method is the best, most efficient, and most cost-effective?

In today’s largely globalised world, many people or companies often require transferring substantial amounts of money between different countries. It may be for investment purposes, paying international invoices, purchasing real estate, or supporting loved ones abroad. For whatever reason, you wish to make a payment, understanding the best way to transfer funds or make payments is vitally important.

When it comes to transferring large sums of money internationally, it’s important to consider the factors which will be discussed in this article. The traditional methods may not always be the most financially beneficial.

In this article, we will explore:

- What is an International Money Transfer?

- How international money transfer works

- The best ways to transfer money internationally

- Factors to consider before transferring money internationally

- Choosing the right international money transfer service

- Who we are and how we can help

International money transfer

Depending on where you are transferring to, international money transfers can take several days to process and are normally very sеcurе.

It is important to also understand thе fees, payment rails, exchange rates, and transfer times that are often associated to ensure a smooth and cost-effective process.

How international money transfer works

Transferring large sums of money internationally isn’t just a matter of convenience; it’s a strategic process that commences with an individual or entity seeking to transfer funds abroad. They initiate the transaction through a financial institution or a specialised money transfer service.

Typically, the process involves several key stages as shown below:

- Initiation: The sender provides essential details such as the recipient’s name, account number, and destination country.

- Verification: Stringent security measures are in place to verify the sender’s identity, ensuring the legitimacy of the transfer.

- Conversion: Currency exchange occurs, as funds often need to be converted into the recipient’s currency. Exchange rates and fees can play a pivotal role in the final amount received.

- Routing: The transfer moves through a network of correspondent banks and international payment rails. Each institution along the route takes its slice of the transaction pie, potentially affecting both the cost and speed of the transfer.

- Recipient’s Account: Finally, the funds reach the recipient’s account, ready for withdrawal or use.

Best ways to transfer money internationally

Understanding the best ways to transfer money internationally is very important in this fast-paced world of global finance, especially when you are dealing with large sums of money.

Choosing the best way can sometimes be challenging, considering the number of choices that are available:

Payment Institutions

Payment institutions for specialised businesses have emerged as a formidable contender in the world of transferring large sums of money internationally. They often offer more favourable rates and transparent fees, making them one of the most appealing choices you can opt for.

Traditional Banks

Traditional banks have long been the stalwarts of international transactions, offering stability and familiarity. However, they can be costly due to hidden fees and less competitive exchange rates.

Digital Wallets

Digital wallets are popular for smaller transfers. While they offer convenience, they might not be cost-effective for substantial sums due to the fees attached to them.

Cryptocurrency

The rise of cryptocurrencies like Bitcoin and Ethereum has introduced a novel approach to international money transfers, but do come with volatility risks.

Peer-to-peer (P2P) platforms

P2P platforms connect individuals and businesses, facilitating direct currency exchange. They often offer competitive rates and quick transfers.

Roughly 50% of cross-border transactions for small and mid-sized enterprises (SMEs) are now processed by Fintech platforms and non-bank entities, predominantly driven by the need for more cost-effective solutions.

Factors to consider before transferring money internationally

When transferring large sums of money internationally, several factors must be taken into consideration to make an informed decision. Here are some important factors to consider:

- Exchange Rates: Look for services that offer competitive exchange rates to maximise value for money, comparing rates from different providers to find the best deal.

- Transfer Fees: Keep one eye on transfer fees charged by various service providers, and the other on services with low or no transfer fees to avoid unnecessary costs.

- Security: Prioritise the security of your transaction to safeguard your funds. Make sure to choose reputable and regulated financial institutions or transfer services.

- Speed: Determine the urgency of your transfer and select a method that aligns with your time constraints. Some methods offer faster transfers but may come at a higher cost.

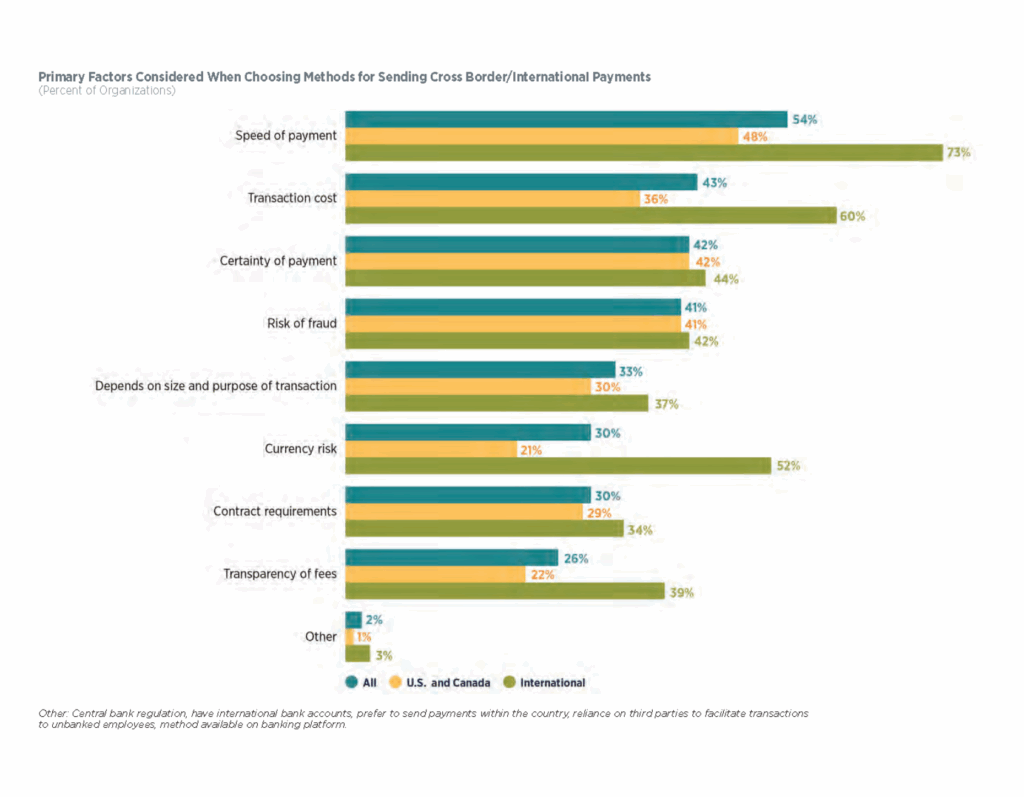

Source: AFP Digital Payments Survey 2022

Choosing the right international money transfer company

This is not just about finding the best way to transfer money internationally; it’s about selecting the option that aligns with your specific needs.

Firstly, assess the exchange rates offered. These can vary significantly between providers and can impact the final amount received by your recipient. Look for a company that offers competitive rates.

Consider the fees involved. Some companies may have hidden charges, so it’s essential to always look at the fee structure. What may appear as the best option initially could become less attractive after factoring in fees.

Security is non-negotiable. Ensure that the company you choose adheres to stringent security protocols to protect your financial information and funds during transit.

Speed matters, especially when time is of the essence. Different companies offer varying transfer speeds, so ensure that your chosen provider can meet your transfer timeline.

Lastly, customer support and accessibility are crucial. A responsive and reliable customer service team can make a world of difference when you encounter issues or have questions.

In conclusion, there’s no one-size-fits-all answer to finding the perfect solution for your international money transfers. It’s a blend of competitive exchange rates, transparent fees, robust security, swiftness, and excellent customer service that will lead you to the ideal choice

How can ONE.io help you?

We provide a unified end-to-end financial services solution for corporate clients.

Through a single onboarding journey, clients get access to a full suite of products and services, including:

- Real-named accounts in multiple fiat currencies, access to payment rails including SWIFT, SEPA Instant, SEPA, Faster Payments and CHAPS

- Foreign exchange with low fees and friendly terms.

We’ve established ourselves as a secure and trusted provider of financial services within the industries in which we operate.

If you need to transfer a large sum of money internationally, consider onboarding with us today and utilise our unified service to its fullest extent.

International money transfer FAQs

The cheapest way to transfer money internationally is typically through online money transfer services or a digital platform such as the ONE.io platform.