February 12, 2024: Busy Week for UK Data

February 12, 2024

Market run-through

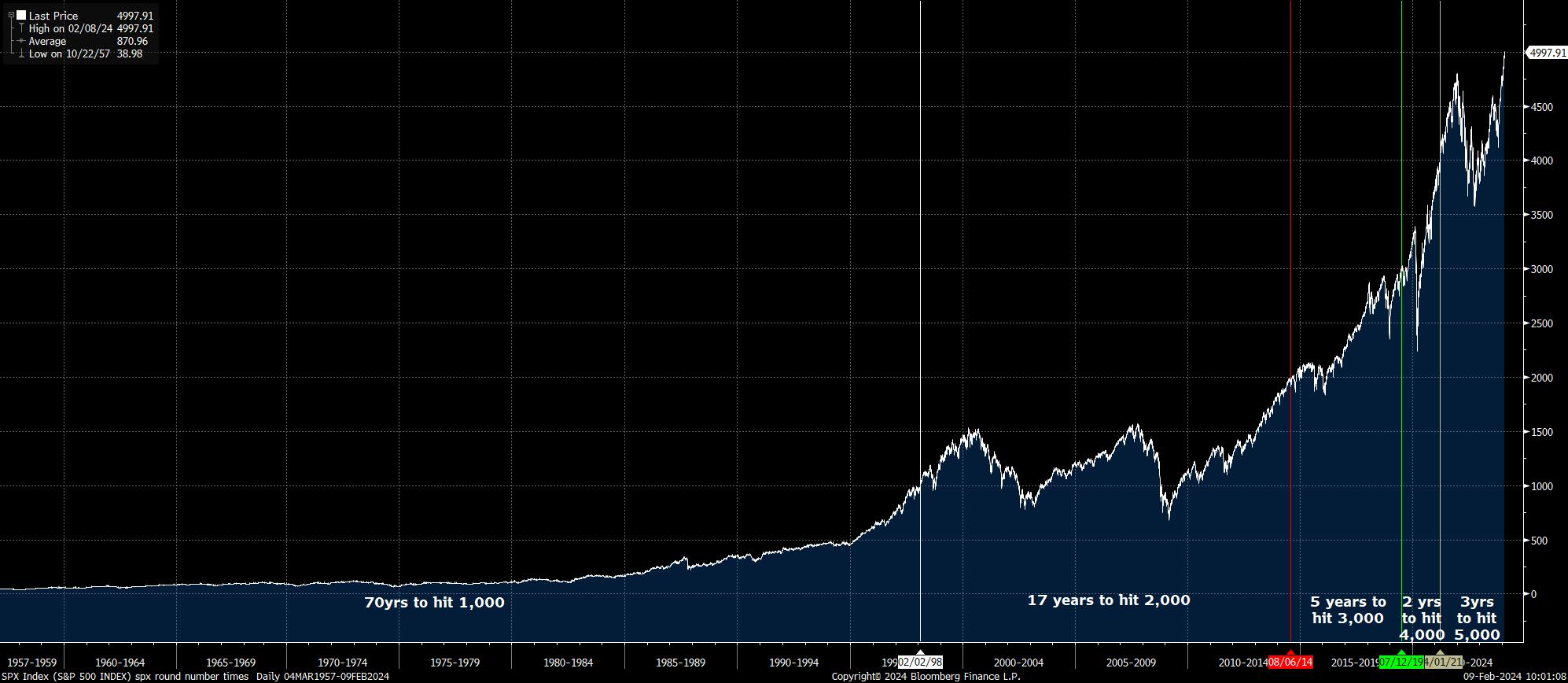

A quiet week was had by all last week, with currencies mainly on the sidelines as US equities hogged the headlines. New high upon new high with the S&P 500 breaking 5000 for the first time. With the strength shown by the last US Non-Farm payroll figures backed up by the most recent weekly figures, it seems onward and upward for the US economy without a care in the world. Even the US treasury’s most recent auction went without a hitch, ignoring the tsunami of issuance that lies ahead. Rate-cut bets continue to recede as the economy continues to exceed all expectations. So, all appears good; even last Friday’s US inflation adjustments were benign. There are, of course, some clouds on the horizon, not least the potential repercussions from Evergrande’s demise in China. Commercial property looks vulnerable, as do some of the smaller banks that have financed it. Europe is, of course, another matter and stays calm, whilst the week ahead gives us an excellent opportunity to look at how the UK is faring with the economy’s monthly MOT of data upcoming.

As normal in the UK, there is an air of confusion emanating from the Bank of England, but hopefully, the picture of the economy will become clearer over the next few days. Private sector wage data will be released Tomorrow when we see CPI. The inflation figure, particularly services inflation, will influence how the Old Lady views the future path of interest rates. Inflation doesn’t feel like it’s dropping, and there may be a nasty upside surprise for Rishi Sunak in the data ahead of Thursday’s by-elections. Later this week, GDP and Retail Sales will be released, neither of which are forecast to set the world alight. The biggest scheduled event of the week, US CPI data, is released tomorrow afternoon. Also released stateside are retail sales on Thursday, which are expected to be soft due to the dreadful winter weather the US has experienced. With plenty of speakers from the central banks added to the mix, it should be an eventful week.

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

Bitcoin has rebounded impressively from its dip below $40,000 and has now surged past $47,000. Many investors harbour an optimistic outlook for Bitcoin, envisioning $50,000 as the next milestone before potentially skyrocketing further. However, despite Bitcoin’s demonstrated resilience in recovering from previous downturns, I remain cautiously sceptical, anticipating the likelihood of yet another sell-off event followed by some accumulation before a true bullish phase ensues. While the BTC bulls may entertain the notion of breaching $49,000, I believe the eagerly awaited moment has yet to materialise. Crypto markets are renowned for their volatility, capable of erasing millions in valuation within minutes. It wouldn’t be surprising to witness another dip below $40,000.

In a landmark day for the spot Bitcoin ETF, inflows surpassed $400 million in a single day since its debut. Numerous analyses attribute this surge to the ETF’s burgeoning popularity, with holdings swelling by 9,260 BTC, as reported by BitMex Research. Leading the pack is BlackRock’s IBIT fund, boasting a $4 billion asset base, closely trailed by Fidelity’s FBTC with $3.4 billion.

This week, on the trading desk, our focus extends beyond monitoring Bitcoin’s price and accompanying volatility arising from key milestones. It promises to be a bustling period on the economic calendar, with CPI news expected to trigger fluctuations not only in the FX markets but also in crypto prices. We are poised to adeptly navigate this volatility, with the hope of discerning clearer market directions, not just within the crypto sphere but also across foreign exchange, as we vigilantly monitor the dollar index.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

The S&P 500 rallied north of the 5,000 mark for the first time ever last week, as equity bulls continue to run away with themselves, amid a ‘goldilocks’ macro outlook, with the US economy looking set for a ‘soft landing’. The lack of any major news or data catalysts largely allowed riskier assets to take the ‘path of least resistance’ last week, though it is notable how equities have managed to continue to gain ground, despite Treasury yields rising to fresh YTD highs in the belly of the curve, and despite earnings season being somewhat subpar thus far (the number of firms reporting upside EPS surprises is below both the 5- and 10-year averages). This speaks to a significant degree of resilience within the market, a factor to which the broadening nature of the rally – with 7 of the S&P’s 11 sectors now positive YTD – also alludes. Of course, risks remain, though barring a nasty hotter-than-expected CPI print on Tuesday, the balance of risks likely continues to point towards further upside into Nvidia earnings on 21st Feb.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.