March 25, 2024: Hawks 0 Jays 1

March 25, 2024

Market run-through

The plethora of central bank meetings last week at least delivered one cut in interest rates. The Swiss National Bank was the surprise outlier as it edged its rates lower by .25%, the first central bank to do so. It possibly jumped the gun as it holds quarterly meetings, and if it hadn’t moved now, it would have had to wait until June, which they perceived as being too long and now its odds on another cut then. Conversely, the Japanese made their widely advertised token move upwards; elsewhere, there was undoubtedly a fluttering of dove’s wings. The FOMC meeting was mildly dovish, and The BoE was pretty non-committal, with the MPC showing its standard groupthink and voting 8- 1 in favour of holding rates. Well, non-committal till Andrew Bailey announced that rate cuts were “on the way”. With politics starting to bear down on central bankers both in the US and here, there is certainly outside pressure to cut rates. One factor to remember is that nearly all central banks must ensure ample liquidity to fund the massive deficits created by their respective governments. A cynic might say that with interest rates being predicted to drop this will make selling government debt easier, not that a central bank would ever talk its book.

We now have two holiday-shortened weeks here in Europe, with most centres closed for trading during the Easter holiday on Friday and Monday. However, the US is open on Friday when, arguably, the most important figure of the week and possibly the month is published, which should make for increased volatility. After the recent higher-than-expected PPI and CPI data, all eyes will be focused on the core personal consumer expenditure deflator. Doves will be hoping for a slight easing from the January level of .4% to .3% which would be slow progress. We will have to wait and see whether there has been an easing, but I can assure you there has been no easing of consumer expenditure in this household on chocolate bunnies and eggs! Have a good week and a great Easter!

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

The once tumultuous surge of Bitcoin seems to have settled into a more subdued rhythm. After reaching highs of $73,800 USD, it retraced by 17% to just above $60,700 USD, subsequently rebounding impressively. Undoubtedly, Bitcoin’s price trajectory in this cycle has defied expectations, reflecting the profound influence of institutional investors. Speculation abounds regarding whether we’ve seen the peak, with some forecasting a sharp downturn. However, the unpredictable nature of this digital asset remains constant.

As the halving event looms less than a month away, all eyes remain fixated on Bitcoin. It’s become increasingly apparent that attempting to predict its movements is an exercise in futility; rather, one must adapt to its fluctuations. A hopeful prospect is the potential spillover effect onto alternative cryptocurrencies, amplifying market volatility. Despite the notable performance of Bitcoin, altcoins have yet to mirror its success in this cycle, emphasizing its unparalleled dominance. Even Ethereum, typically mirroring Bitcoin’s trajectory, has failed to keep pace.

What’s evident, though, is the steadfast resolve of investors to hold onto their Bitcoin holdings. Off-ramping activity has significantly dwindled, with on-chain transfer values falling below those seen during the peak of the 2021 bull market. It’s a testament to investors’ conviction in Bitcoin’s future trajectory and their willingness to endure the ride.

Selling Bitcoin at this juncture seems premature; any price below its all-time highs could be viewed as a discount. Ethereum, particularly with the potential approval of an ETF in the offing, holds promise for future growth. On the trading desk, liquidation activity has been pronounced for assets like LTC and XRP beyond certain thresholds, yet Bitcoin holders remain steadfast in their resolve — a sentiment shared here. I remain bullish all around.

Alex-Desmond Brathwaite, Senior Trader

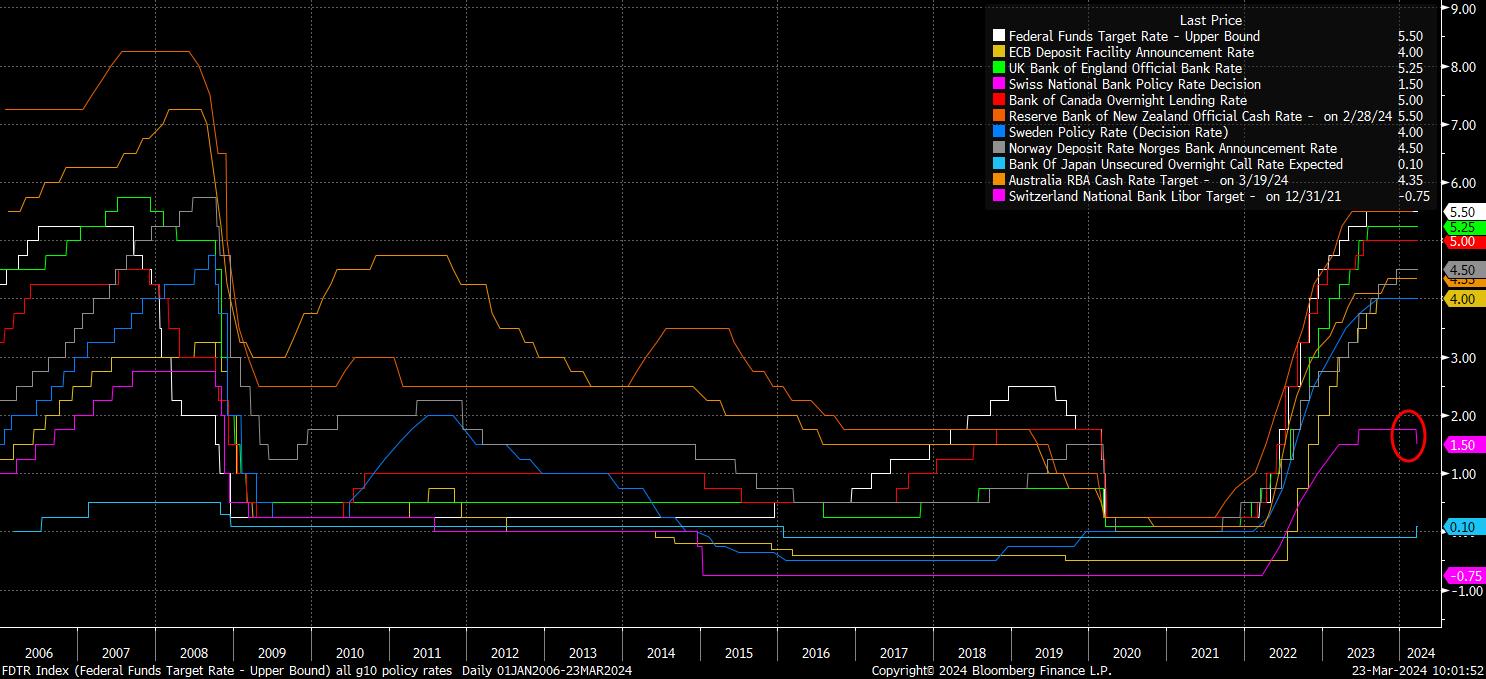

Chart of the week

And, they’re off! The ‘summer of easing’ got underway slightly earlier than expected this week, with the Swiss National Bank becoming the first G10 central bank to deliver a rate cut this cycle, in what was a surprise move from Thomas Jordan & Co. The week’s other policy decisions were all largely as expected, with the FOMC continuing to signal three 25bp cuts this year, the BoE nudging further in a dovish direction as the two hawkish dissenters from February fell back in line with the majority of the MPC, and the RBA ditched the tightening bias from their statement. Altogether, this reinforces how supportive the policy backdrop remains, and how additional support remains on the horizon in the short-term, continuing to create a strong tailwind for risk assets, with the central bank ‘put’ alive and well. Of course, the BoJ did buck the trend, with a 10bp hike to end the negative rates experiment, though there is frankly little value in worrying about such a modest move, when the broader direction of travel being firmly in the direction of policy normalisation.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.