December 04, 2023: Market Confidence Grows

Market run-through

The last month of the year has started, and certainly, there is a chill in the air in London, not on Wall Street, where stock markets had an excellent week. Indeed, US stocks had the second-best November since the 1980s. With interest rates seemingly at their peak in the US, traders’ appetite for risk has returned with a vengeance, and all looks good for 2024 and beyond. The doomsters amongst us would point out that the price of oil isn’t exactly pointing to a world without a recession, and of course, as risk drops, so does the yield on the 10-year and undoes a lot of the heavy lifting that the Fed has been reliant on over the last couple of months. In his fireside chat, Fed Chairman Jay Powell continued to urge caution but certainly didn’t contradict the confidence that Fed Governor Christopher Waller has in expecting a soft landing.

Employment, employment, employment that’s what it’s all about in the week ahead, and we kick off with ADP’s white-collar number on Wednesday, followed by the weekly unemployment claims before the big one on Friday, Non-Farm Payroll. After a lacklustre report in November, analysts expect a rebound and a more positive figure of around 200,000. Unemployment is expected to stay steady at the 3.9% level, but wage growth is seen softening. It should be remembered that November and December are difficult numbers to call because of national holidays. There is little to excite elsewhere apart from ISM’s diffusion indexes, which are expected to be somewhat gloomy. With the last Fed meeting of the year next Wednesday, volatility is likely to remain low. However, the dollar looks likely to come under some pressure as anticipation of the Fed cutting rates grows. Have a great week, and remember, be careful out there.

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

The Bitcoin bulls are back! This seems to be the sentiment from the majority of individuals in the crypto industry. We have witnessed continued bullish pressure as the price of BTC has crept towards the $40,000 mark, up almost 15% since November 1st alone.

Over the past week, ONE has experienced an increased number of buy orders, a wonderful sign indicating more upward momentum. One of the leading blockchain data and intelligence platforms, Glassnode, has shown that over $1.4 billion worth of BTC has been withdrawn from cryptocurrency exchanges since November 17th. This mass withdrawal of funds suggests that investors are biased towards a long-term hold, even though it could also reflect a distrust in exchanges and holding funds with them, given the events with FTX, followed by the Binance and Kraken fines. The overall market cap of crypto has risen to $1.5 trillion; we haven’t seen these levels since May 2022.

With all the current excitement in the crypto market, HM Revenue and Customs had a few encouraging words for all cryptocurrency owners. In a process with the sole purpose of targeting crypto asset owners, HMRC has urged crypto holders to disclose any unreported crypto gains, in an effort to tackle the issue of unpaid taxes. This warning comes in the wake of the UK implementing an Organization for Economic Cooperation and Development-led program that may require crypto trading platforms to share customer information with tax authorities. It is believed that the estimated tax not paid on crypto asset holdings could range from 50% to 95%.

In more positive crypto news, amid the recent crackdown in the United States surrounding crypto regulations, more crypto firms have flocked to the UAE. The United Arab Emirates has always seemed to be a place where the biggest names in crypto want to gravitate. Dubai, the largest city in the UAE, has always had grand plans to be one of the top global financial centres, growing as a business and financial services hub for the Middle East over the last few decades. The UAE’s recent introduction of regulatory frameworks for decentralized autonomous organizations, virtual asset providers, metaverses, and other Web3-related entities has certainly made progress toward a clear compliance infrastructure, moving the UAE closer to fulfilling its goal of being an international financial hub.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

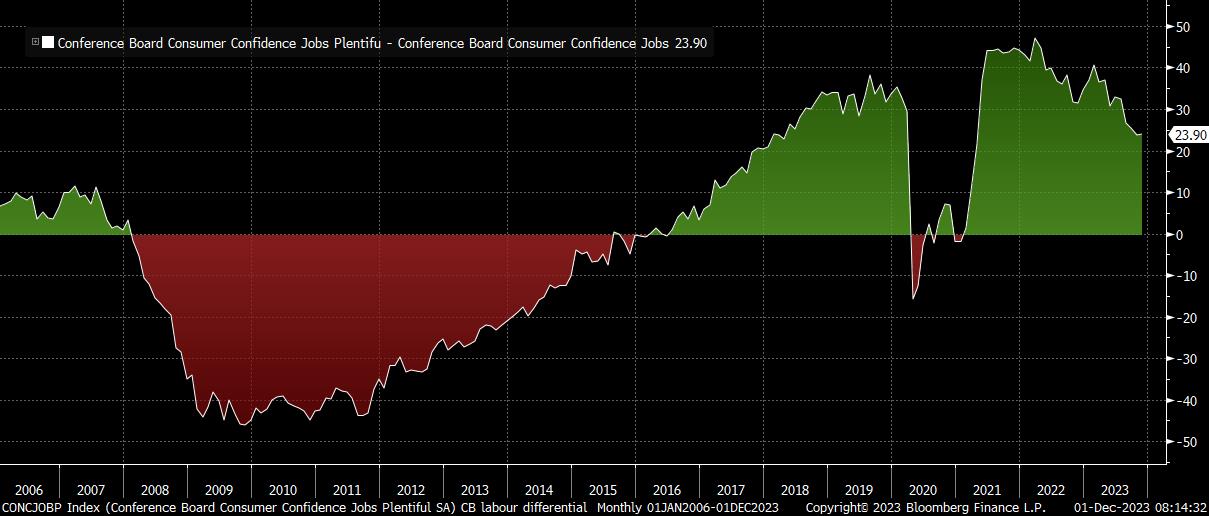

The Conference Board provided us with their latest survey of US consumer confidence this week, with the headline gauge remaining at a relatively subdued level. Of more interest, though, was what the survey told us about respondents’ views on the labour market. Increasingly, the number of respondents viewing jobs as ‘plentiful’ is declining, as the number seeing jobs as ‘hard to get’ steadily rises. In turn, this is seeing the so-called ‘labour differential’ begin to narrow rather rapidly, now sitting at its lowest level in just over 2 years. This provides yet another indication of what the year ahead is likely to hold for the US economy, as waning consumer demand amid the lagged impact of the Fed’s tightening cycle causes a steady but significant loosening of the labour market. Of course, the November jobs report is due on Friday 8th December, and may point to further signs of this loosening, though one must contextualise such data, given that a more slack labour market is exactly what policymakers have spent eighteen months trying to engineer, via the ‘higher for longer’ policy stance.

Michael Brown, Market Analyst at Pepperstone

The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.