April 08, 2024: Questions Outnumber Solutions

April 08, 2024

Market run-through

The phrase more questions than answers rather neatly sums up the current financial markets, with US data being the fulcrum of the conundrum. As if to underscore the issue, Jolts were subtly disappointing, as one analyst said, whilst last Friday’s Non-Farm Payrolls beat all expectations. Fed officials are equally contradictory, but less and later, with regard to interest rate cuts, it seems to be the overriding message. Indeed, equity markets backed away from their highest levels during the week, and the Panglossian view of the world they have been taking seems to have dimmed slightly. With geo-politics looking increasingly fraught, this is to be expected. With an increasingly likely escalation of the Middle East conflict, the sharp upticks in Oil and Gold are understandable.

Whether the world’s travails overshadow next week’s data, we will have to wait and see. However, there is, without doubt, a mood-setting release scheduled for Wednesday afternoon when CPI is released in the States. With uncertainty surrounding inflation and signs that it may be remerging, this is a key number and will help decide whether the Fed can get an early cut in rates. A small drop to 0.3% monthly is widely predicted (annualised to 3.7%) at the core level, which is unlikely to give doves on the FOMC much cheer. Talking of the FOMC, the minutes of their last meeting are published mid-week, which should provide a hint on how they see the path for interest rates. The ECB is also meeting, after which we may get a clearer picture of the future path of interest rates in the Eurozone, with June favoured for a first cut. If the ECB hint strongly at a cut, the euro should come under further selling pressure. The only figure of significance in the UK is GDP. This is forecast to show the UK recovering from a shallow recession. Still, in all honesty, the statistics have been so volatile recently that they are unlikely to move the markets to any great extent.

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

Amidst the anticipation surrounding the impending BTC halving, an air of tranquility envelops the market, with investors poised in anticipation, awaiting the unfolding of events. The cryptocurrency space, known for its penchant for volatility, seems to relish in the thrill of unpredictability. The Bitcoin halving, a quadrennial event that slashes the BTC supply in half, traditionally triggers price surges, yet the question looms: has the market already factored this in?

Surprising many, a significant influx into spot bitcoin exchange-traded funds (ETFs) occurred, constituting a supply shock. As the weeks lead up to the halving, speculation abounds, but one thing remains clear: regardless of short-term fluctuations, the long-term trajectory appears promising.

BTC’s staggering 75% year-to-date surge, coupled with repeated breaches of all-time highs pre-halving, marks uncharted territory. The fervent demand for ETFs underscores the asset’s allure, with supply limitations viewed as a boon rather than a bane. This positive sentiment is poised to spill over into Ethereum (ETH) and alternative cryptocurrencies (alt-coins), albeit with varying degrees of upside potential and heightened volatility.

Reflecting the broader market sentiment, the trading desk notes a marginal decline in BTC transactions, mirroring the overall market deceleration. Interestingly, a trend emerges as investors shed altcoins like DOGE and Cardano, despite modest gains, while Litecoin (LTC) maintains its popularity. As the calendar turns, uncertainty looms, but readiness to adapt to market dynamics remains paramount.

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

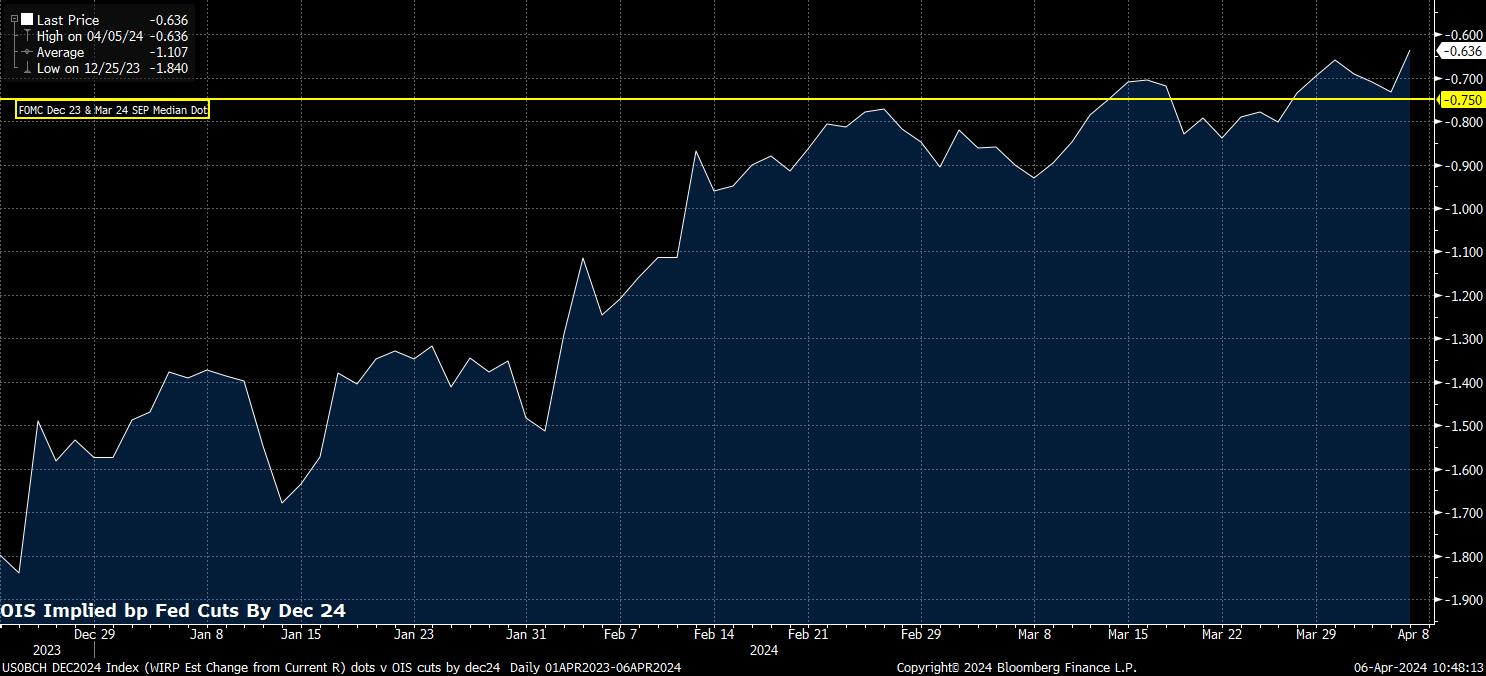

Last week gave markets plenty to digest, not least after another blowout nonfarm payrolls print showed the US economy adding 303k jobs in March, pointing to the remarkable resilience of the US jobs market persisting, with payrolls growth seemingly impervious to the over 500bp of tightening that the FOMC have delivered. This, along with the continued stickiness of inflation – on which we will get our latest update this week – has led to a notable shift in the Fed’s rhetoric, with ‘no rush to cut’ seemingly the consensus among Committee members, judging by this week’s deluge of Fedspeak. Market expectations have also shifted significantly, with at one point USD OIS implying that the first cut wouldn’t come until September, though this repricing has since pared. In any case, swaps now imply just 64bp of easing will be delivered this year, substantially less than the median dot in the March SEP. A fourth hotter-than-expected CPI print in a row this week would likely spur a further hawkish repricing, posing upside risks to the USD as a result, and downside risks to Treasuries, with yields across the curve starting ‘CPI week’ at fresh YTD highs.

Michael Brown, Market Analyst at Pepperstone

Disclaimer: The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.