January 09, 2024: Traders Question the Year of the Cut

Market run-through

Just when we all thought this year would be the year of the cut combined with lovely gentle markets, the US economy and geopolitics stirred us out of our post-festivities slumbers. The stock markets appeared to smell something afoot earlier than most. They started the New Year with a wobble caused mainly by the worsening geo-political situation rather than anticipating the employment data. With the safe passage of ships and goods through the Suez Canal looking more challenging by the day and winter descending over much of Europe with a vengeance, the markets’ certainty that inflation is beaten starts to look premature. However, going into Friday’s Nonfarm Payroll, traders were still confident of a number that would show signs of a worsening job market, especially with vacancies dropping. Instead, another better-than-expected number and higher-than-expected hourly earnings were released, which gave further fuel to the dollar rise before slightly disappointing ISM data capped its rise.

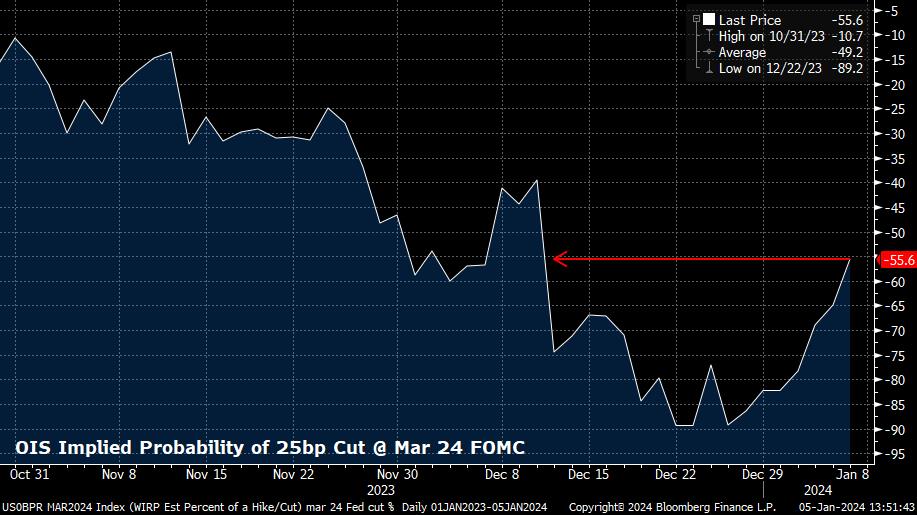

At the end of the first week of January, we are left with the size and timing of the interest rate cuts scaled back, which Michael Brown expands on in his Chart of the Week. And now, even the eurozone’s appetite for them seems to have been reduced after inflation came in stronger than expected at 2.9%. This week, our attention will turn to the US inflation data, with December’s CPI expected to break 4% when it is published on Thursday. Closer to home, December’s monthly GDP is posted on Friday. Still, in honesty, this series of data is no longer as important as it once was and, when released, seems to increasingly come with an explanation or, to be more accurate, an excuse. Anyway, plenty to play for this week and enjoy the ride!

Richard Matthews, Head of FX and Payment Partnerships

Behind the desk

Happy New Year! It’s indeed an exciting time for the crypto industry, especially with the anticipation surrounding the potential approval of a spot Bitcoin ETF by the SEC. If approved, this could mark a significant milestone for the crypto market, opening up new avenues for institutional investments.

The expectation of a regulated offering attracting billions of dollars in Bitcoin demand is a testament to the growing interest and acceptance of cryptocurrencies within traditional financial circles. If this comes to fruition, it could be a historic event with far-reaching implications for the crypto space.

The initial impact on the market could indeed be substantial. The influx of billions of dollars into Bitcoin, coupled with a limited supply, might drive prices higher due to increased demand. This, in turn, could lead to a positive sentiment across the entire crypto market.

It’s interesting to note the shift in trading behaviour on ONE’s trading desk, with heavy trading on the TRC network. This may be a response to the high fees associated with the Ethereum network, which has experienced congestion due to increased demand. It reflects the dynamic nature of the crypto market as users seek more cost-effective and efficient alternatives.

The fact that holders are storing their crypto in personal wallets, possibly in anticipation of market movements, suggests a strong belief in the long-term potential of cryptocurrencies. It’s a sign that participants are committed to riding out the market fluctuations, showcasing resilience in the face of the crypto rollercoaster.

As we enter 2024 with optimism, it will be fascinating to see how the crypto landscape evolves, especially if the spot Bitcoin ETF is approved. Here’s to a successful and transformative year in the world of cryptocurrencies!

Alex-Desmond Brathwaite, Senior Trader

Chart of the week

2024 has already brought some surprises with the year barely a week old, chief among which being the substantially hotter than expected US jobs report, with headline nonfarm payrolls again rising more than expected, with the economy having added 216k jobs last December. This, coupled with a handful of other better than expected releases, including upward revisions to the S&P Global PMI figures, has led to a rather notable hawkish repricing of policy expectations. This is shown not only by the sell-off seen across the Treasury curve, where 10-year notes now yield above 4% once more, but also by OIS pricing, where money markets now see a 25bp Fed cut in March as a coin-flip, pricing the lowest probability of such a move since Chair Powell’s perceived dovish pivot at the December FOMC. Minutes from that meeting, also out last week, showed little desire among policymakers to guide towards easing any time soon, likely giving the aforementioned hawkish repricing more room to run, posing upside USD, and downside equity risks as a result.

Michael Brown, Market Analyst at Pepperstone

The views contained herein are not to be taken as a recommendation or advice. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on ONE’s website and wish to rely upon, whether for the purpose of making an investment decision or otherwise. It should be noted that investment involves risks, the value of investments may fluctuate in accordance with market conditions and investors may not get back the full amount invested.

Not all ONE services may be available to UK customers.